Just what are Settlement costs?

Exactly what are we paying for exactly during these can cost you? Why are they requisite, as well as how will we keep them as little as possible?

Settlement costs belong to step one out-of cuatro kinds: Lender Charges, Taxes & Govt. Costs, 3rd party Costs (eg Appraisers and you can Name enterprises), and you may Pre-paids (such as for example homeowners insurance and you may assets income tax).

That it video often break down just how all of those individuals works, and just how Improvements should be maximized and you can/otherwise discussed to keep your costs reasonable.

step 3 Gates: Conventional, AIO, otherwise AIO+?

All in one was a smart choice for most home owners, but really oftentimes clients are leftover unaware about any of it an any alternative. Brand new standard alternative-a great 30yr repaired loan-is the best some people is also qualify for, but once you find out how much currency you could cut (during the attention fees), you probably cannot actually imagine for the last. But that’s just the beginning.

Inside video clips Aaron teaches you how you can net $step one,000,000+ (into good $450,000 mortgage!) when you’re smart toward Everything in one. It is Door #step three. And it’s really the entranceway you want!

What about Construction Funds?

All of our construction mortgage coordinated with an all in one put you except that one battle-by a kilometer. We’ve step 3 options for your having construction funds: One-time intimate, repaired rates; One-day romantic, ARM; or One or two-time close.

Since the majority of one’s clients are looking for getting into AIO as quickly as possible, might choose a-two-date close. This means you should have a casing financing that you pay appeal-merely toward at the time of construction (like any your almost every other framework funds), however, during the time of completion you’ll indeed refinance you to definitely to your a permanent financing of your choosing. Usually the one-date choices do not require a great refinance, but also don’t let for conversion process with the AIO.

If you want to manage Framework to your Everything in one, you’ll want both-big date close. As the we are able to perform Vacant Belongings, The fresh new Framework, as well as in one (all-in-house), we are able to get this process smooth and simple, merely requiring a few updated records during the time of this new refinance to relieve any fret otherwise nightmare that might generally match closing on the a unique loan.

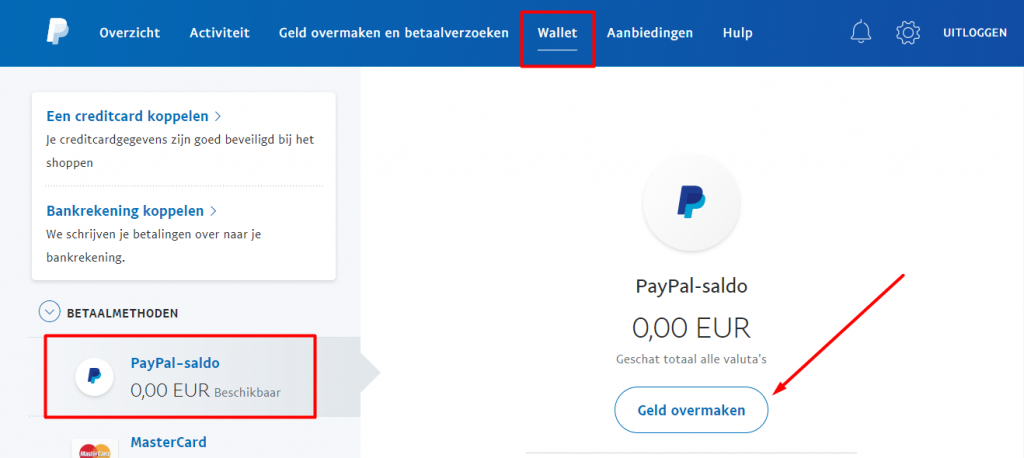

Like any almost every other purchase otherwise re-finance, you’ll find regular settlement costs with the a keen AIO Financing. There are lots of extra charges (doing $dos,000), and there’s good $65 yearly payment to replenish the new credit line, same as there is to your other HELOC, you to definitely begins another season.

In order to counterbalance so it debts, i waive every origination costs for the AIO loans. Once the home financing bank, we can easily do that. (Note: Agents aren’t.)

Besides these types of costs, there are no novel otherwise most charges for an AIO mortgage as compared cash advance near me to a normal mortgage.

Note: Toward an enthusiastic AIO re-finance, closing costs can go to your the new loan, demanding $0 bucks to shut usually.

What’s the rate of interest?

The speed* is actually a mixture of two amounts: 1) a beneficial margin that you choose (of numerous readers discover 3.75%* because it will set you back zero dismiss activities; which margin can be bought off if you prefer) + 2) a catalog-we utilize the step 1 Yr Constant Readiness Treasury.

During the is the reason AIO mortgage interest are step three.80% (step three.5% + 0.3%) in the most common people’s circumstances. For those who refinanced on the AIO loan and you may purchased on the margin to 3%, your rate inside February should’ve been step 3.30%, except-it might need to go doing step 3.75% for the reason that it is the flooring toward AIO financing; the speed can never end up being lower than the floor, even if the margin + directory increase several lower than the floor.